This article offers a detailed and comprehensive guide for establishing a crypto investment fund in Vietnam, covering everything from defining the investment strategy to managing the fund's operations while ensuring adherence to legal requirements.

Steps to establish a Crypto Foundation

Steps to establish a Crypto Foundation

Before launching a crypto foundation, the first step is to establish a clear mission and strategic direction. The foundation's structure should reflect its objectives, values, and approach to managing funds and assets. Key considerations include:

- Mission and Objectives: The foundation must clearly define its long-term mission and goals. These can include supporting the growth of blockchain technology, contributing to the development of the crypto ecosystem, funding research or promoting blockchain adoption in various sectors (e.g., finance, healthcare, supply chain).

- Asset Allocation and Investment Focus: The foundation must develop a strategy for managing and allocating its assets, which may include investments in cryptocurrencies, blockchain infrastructure projects, or research initiatives. This may involve:

Due to the absence of specific regulations in Vietnam regarding the establishment of cryptocurrency investment funds. Investors could establish a fund in the manner of an innovative startup investment foundation to invest in crypto projects, as specified in Decree 38/2018/ND-CP.

Based on the provisions of Article 11 of Decree 38/2018/ND-CP, the procedure for establishing an innovative startup investment fund is as follows:

Step 1: Prepare dossier

First, you need to prepare the investment fund establishment dossier, which should include the following documents:

Step 2: Submit the application

Within 5 working days from the date the innovative startup investment fund is established, the fund management company must submit the application for the establishment of the fund to the business registration authority where the company’s head office is located, before the fund begins its operations.

Step 3: Process the application

The business registration authority is responsible for reviewing the validity of the notification and accompanying documents within 15 working days from the date of receipt.

Step 4: Publish information

Within 5 working days from the date of receiving the valid establishment notification, the fund management company must publish information about the establishment of the innovative startup investment fund on its website or electronic portal.

The company must send a copy of the fund establishment notification to the Ministry of Planning and Investment for publication on the National Portal for Supporting Small and Medium Enterprises. The fund may only commence operations after its information is published on the National Portal for Supporting Small and Medium Enterprises.

Furthermore, organizations or individuals seeking to establish a fund in Vietnam may encounter administrative challenges. Additionally, an innovative startup investment fund can be formed with up to 30 investors contributing capital, as outlined in the fund's charter.

Consequently, investors could participate in or contribute capital to a crypto foundation in Vietnam. Several crypto foundations in the country are actively investing in this sector, including:

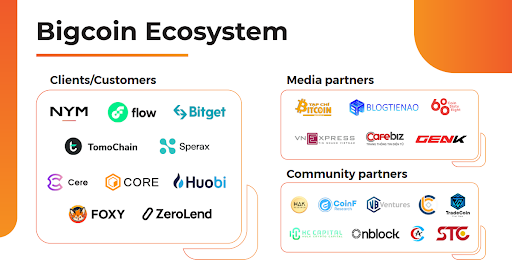

Bigcoinvietnam ecosystem

With five years of experience in the Vietnamese market, BigCoin has established itself as a trusted leader in the blockchain and cryptocurrency space. Over these years, the company has gained a profound understanding of the local market dynamics, user behavior, and cultural nuances, positioning itself as a key player in the rapidly evolving digital economy.

BigCoin has successfully partnered with more than 100 projects, including exchanges, marketing agencies, audit firms, launchpads, legal consultancies, and other key stakeholders, forming a comprehensive ecosystem that serves the diverse needs of blockchain and cryptocurrency ventures. This extensive network enables BigCoin to provide a full suite of services for any project, from inception to launch and beyond.

Entering a new market can be a challenging task, especially when there is limited understanding of the local potential, user habits, culture, and social impact. BigCoin recognizes these challenges and addresses them through its deep market insights and thorough research. By offering in-depth analysis and actionable market intelligence, BigCoin empowers its clients to navigate the complexities of the Vietnamese market with confidence.

As a strategic partner, BigCoin not only provides consultancy services but also works closely with clients to develop tailored marketing strategies that align with their objectives. Whether it's building brand awareness, driving user engagement, or expanding market share, BigCoin is dedicated to supporting its partners throughout their journey in Vietnam.

BigCoin’s role goes beyond consultancy. With a well-rounded approach to marketing, the company offers a complete range of services designed to optimize project performance in the Vietnamese market. This includes market entry strategies, brand positioning, and customized promotional campaigns, all backed by BigCoin's solid network of partners and local expertise.

By choosing BigCoin as a partner, clients can leverage its proven track record, deep market understanding, and vast ecosystem of connections to accelerate growth, enhance visibility, and successfully navigate the competitive landscape of the crypto and blockchain sectors.

Coin98 venture

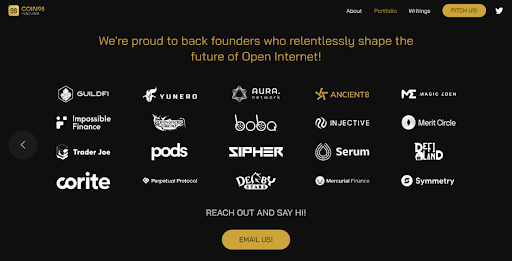

Coin98 venture

Founded in 2017, Coin98 Finance has operated continuously for over six years, specializing in DeFi products. On November 1, 2023, the company officially rebranded as Ninety Eight, signaling a strategic expansion of its activities and a renewed focus on long-term growth. Ninety Eight's mission is to support and invest in startups and companies within the blockchain space, with the shared objective of making Web3 technologies more accessible to everyone.

Having been in the market for over five years, Coin98 contributed to the blockchain and cryptocurrency sectors. The company has supported numerous projects and builders in creating impactful solutions within the DeFi space. The investment arm focuses not only on DeFi applications but also on blockchain infrastructure projects, with investments in platforms such as Ethereum, Solana, Polkadot, and Binance Smart Chain, among others.

Coin98 Ventures has successfully completed several investment rounds in diverse sectors, including:

These investments reaffirm Coin98 Ventures' credibility within the global blockchain development community. Additionally, Coin98 Ventures has partnered with Solana to launch the Coin98 Solana Ecosystem Fund, with a total value of $5 million.

This fund is designed to foster the development and growth of the Solana ecosystem within the Southeast Asian market, with a particular focus on Vietnam.

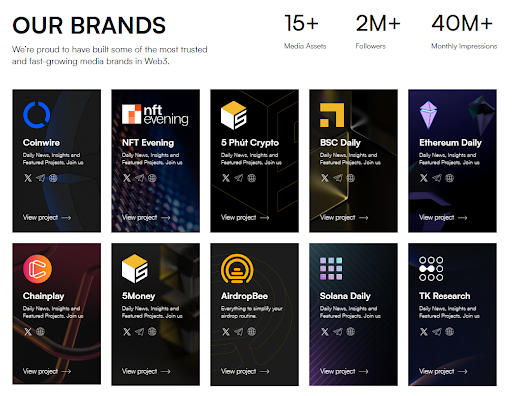

TK venture

TK venture

TK Ventures is a venture capital firm dedicated to supporting early-stage projects within the fields of decentralized finance (DeFi), GameFi, NFTs, and Web3. The firm’s core mission is to serve as a key partner for ambitious founders in the blockchain industry who are building the foundation for the decentralized web.

With a proven track record, TK Ventures has made strategic investments in a variety of prominent projects across the DeFi, infrastructure, Web3, NFT, and GameFi sectors. Notable partnerships include projects such as Impossible Finance, Unbound Finance, Coin98, Starpunk, Wanaka Farm, and EnjinStarter. Beyond investment, TK Ventures also plays an active role as a marketing partner, driving the growth and visibility of these exceptional projects.

The team at TK Ventures brings extensive experience in digital marketing, combined with deep expertise in the cryptocurrency ecosystem. This enables the firm to provide significant strategic value to its portfolio companies, particularly in terms of exposure and market positioning.

TK Ventures operates a wide-reaching media network across platforms such as Twitter, Telegram, YouTube, and TikTok, with a combined crypto ecosystem of over 668,000 followers. These channels generate millions of impressions each month, ensuring that the projects within the portfolio gain significant visibility within the crypto community.

In addition to its strong media presence, TK Ventures maintains close relationships with the companies it invests in, as well as with other strategic venture capital firms and key opinion leaders (KOLs) in the blockchain space. This network allows TK Ventures to offer not just financial backing, but also crucial strategic support, fostering the success and growth of the projects it partners with.

A1: No, cryptocurrency is not banned in Vietnam, but it is not recognized as a legal tender for payments either. The Vietnamese government has issued regulations that prohibit using cryptocurrencies as a means of payment for goods and services. However, owning and trading cryptocurrencies is not illegal, and many individuals and businesses in Vietnam engage in crypto-related activities.

The government has been focusing on regulating the market to prevent fraud and ensure security, while exploring how to integrate blockchain technology into the financial system. Thus, while cryptocurrencies are not banned, they are subject to certain restrictions and regulatory oversight.

A2: Yes, Vietnam's cryptocurrency market shows strong potential. By September 2023, Vietnam ranked second globally in terms of cryptocurrency ownership, with around 21.2% of the population holding digital assets.

Additionally, Vietnam ranks seventh globally in blockchain investment, underlining its growing importance as a blockchain hub. The country has also consistently ranked among the top three in the Global Cryptocurrency Adoption Index for the past three years. With this level of adoption, investment, and market activity, Vietnam is positioned as a dynamic and promising market in the global cryptocurrency space.

A3: One of the key advantages of partnering with crypto foundations in Vietnam is access to local expertise and market insights. Vietnamese crypto foundations have a deep understanding of the local market, including consumer behavior, regulatory developments, and cultural nuances. This knowledge is crucial for navigating a rapidly evolving sector like cryptocurrency, where trends can shift quickly.

Additionally, these foundations are well-positioned to provide guidance on adapting global projects to suit the needs and preferences of Vietnamese users, ensuring better market fit and user adoption. By leveraging this local expertise, investors and partners can make more informed decisions and reduce the risks associated with entering a new and dynamic market like Vietnam.